New Video Explains 2020 Charitable Tax Breaks

- By: Jon Williams

- /

- Tuesday, February 23rd, 2021

Two Arizona tax professionals answer your questions about nonprofit giving

Looking for deductions as you prepare your 2020 taxes? Our new video can help.

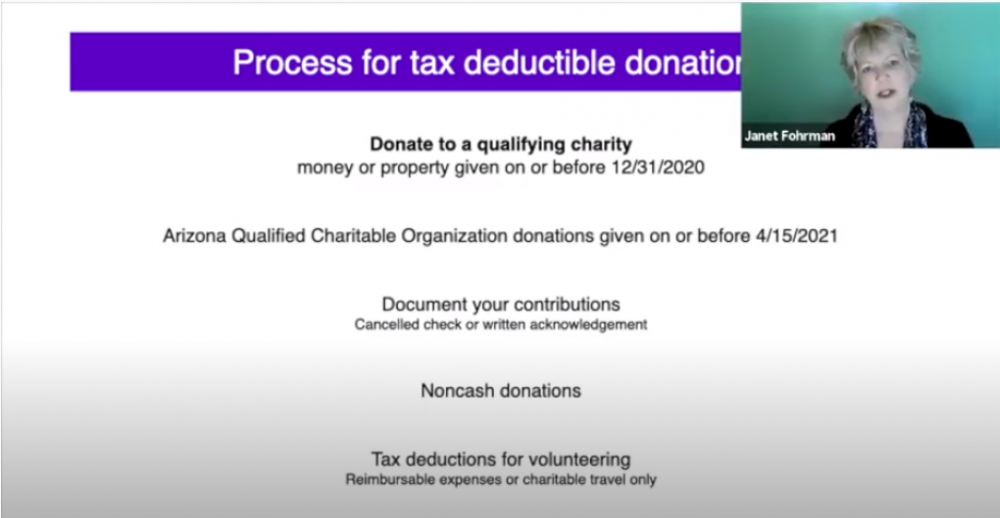

In December, ACBVI taped a webinar with two Arizona tax professionals to answer your questions about nonprofit giving and tax benefits, including the new CARES Act deduction.

Janet Fohrman, CEO of Fohrman & Fohrman, says she was excited to take part in the webinar because, “This video presents a win-win for nonprofits in our community, as well as tax savings for donors.” The video also features Joel Huyser, Partner of Sigrist, Cheek, Potter & Huyser. Watch it HERE.

There’s still time to give to ACBVI and potentially get back up to $800 on your 2020 Arizona taxes. ACBVI’s Qualifying Charitable Organization Code is #20466.

About The Author

Jon Williams

Jon Williams is the Fund Development Officer at ACBVI. He has over 25 years of professional non-profit experience in development, fundraising, volunteer and event management with national non-profits including the American Cancer Society, the American Diabetes Association, and three member food banks in the Feeding America network, including his last position as Development Manager with United Food Bank in Mesa. Originally from South Bend, IN and a graduate of Ball State University, Jon has devoted his career in giving back to the community and providing assistance to those underserved populations needing help. A resident of Chandler, Jon enjoys the Arizona lifestyle along with traveling near and far, a great live concert or an exciting sports game!